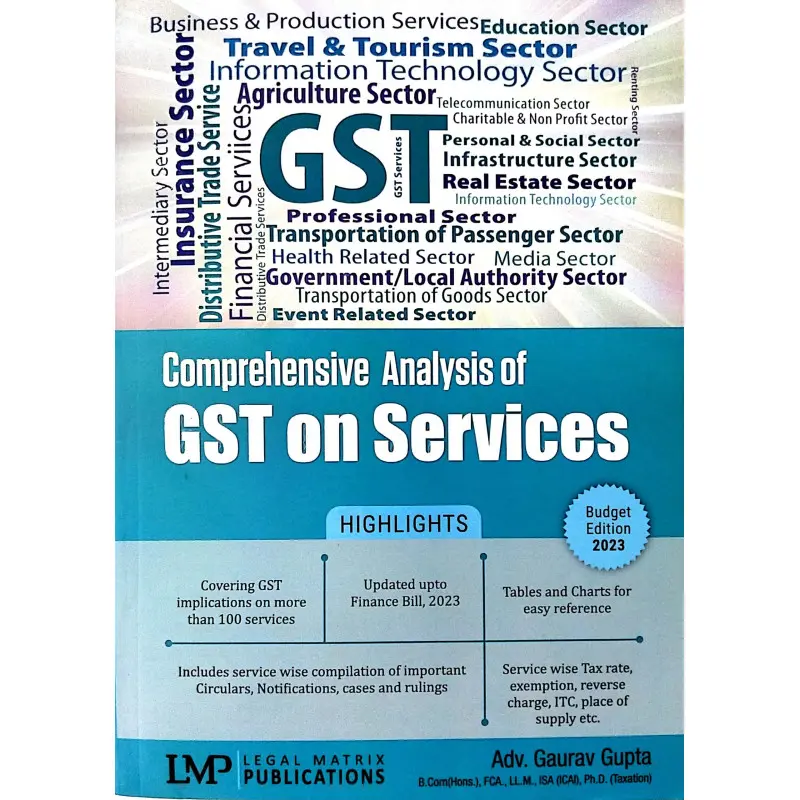

Comprehensive Analysis of GST on Services By Adv. Gaurav Gupta

Edition : 2023

Comprehensive Analysis of GST on Services by Adv. Gaurav Gupta is a detailed and practical commentary on the Goods and Services Tax regime as it applies to services in India. The book provides clause-by-clause analysis of GST provisions, covering supply of services, place of supply, valuation, exemptions, reverse charge, input tax credit, and compliance procedures. It includes updated notifications, circulars, and amendments, along with landmark judicial pronouncements and departmental clarifications. With practical illustrations, industry-specific analysis, and compliance checklists, this book is a valuable resource for tax professionals, lawyers, chartered accountants, company secretaries, business owners, and students of taxation law. Covers supply, valuation, exemptions, ITC, reverse charge, compliance, and latest case laws. Essential for lawyers, CAs, tax consultants, and business professionals. GST on services book, Gaurav Gupta GST commentary, GST law India services, GST compliance guide, GST exemptions services, GST input tax credit services, reverse charge GST book, service tax GST transition, Smart N Law books.

Comprehensive Analysis of GST on Services by Adv. Gaurav Gupta is a detailed and practical commentary on the Goods and Services Tax regime as it applies to services in India. The book provides clause-by-clause analysis of GST provisions, covering supply of services, place of supply, valuation, exemptions, reverse charge, input tax credit, and compliance procedures. It includes updated notifications, circulars, and amendments, along with landmark judicial pronouncements and departmental clarifications. With practical illustrations, industry-specific analysis, and compliance checklists, this book is a valuable resource for tax professionals, lawyers, chartered accountants, company secretaries, business owners, and students of taxation law. Covers supply, valuation, exemptions, ITC, reverse charge, compliance, and latest case laws. Essential for lawyers, CAs, tax consultants, and business professionals. GST on services book, Gaurav Gupta GST commentary, GST law India services, GST compliance guide, GST exemptions services, GST input tax credit services, reverse charge GST book, service tax GST transition, Smart N Law books.

Alternative Products

These other products might interest you